Next page . . . . Previous page . . . . Speeches . . . . Contents . . . . Debates(HTML) . . . .

Legislative Assembly for the ACT: 2002 Week 8 Hansard (27 June) . . Page.. 2399 ..

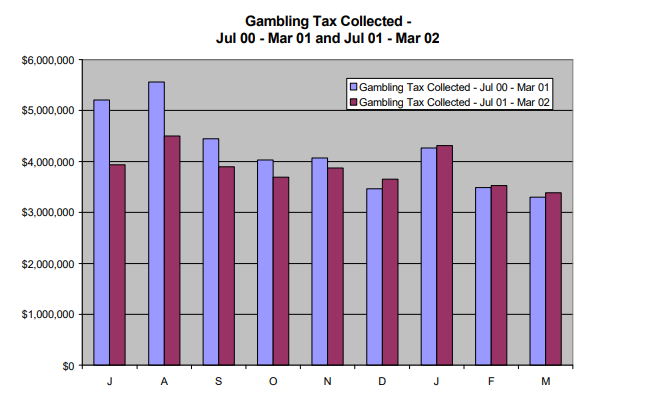

(5) With the exception of July and August 2000, there have been no significant changes to the pattern of payments of gambling tax on a month by month basis between this and the previous financial year. See comparison graph below.

The variances between July and August 2000 and the corresponding months in 2001 occurred as a result of 2001-02 Budget Estimates taking account of approximately $2m of GST payments which were inadvertently forwarded by gaming machine venues directly to the ACT Gambling and Racing Commission rather than the ATO in July and August 2000.

Other main variances to budget estimates that may impact on payment trends for the financial year 2001-02 include:

Interstate lotteries (NSW and VIC) revenue down by $1.2m,

Casino Tax down by $340,000, and

Sports betting revenue up by $180,000.

Next page . . . . Previous page . . . . Speeches . . . . Contents . . . . Debates(HTML) . . . .